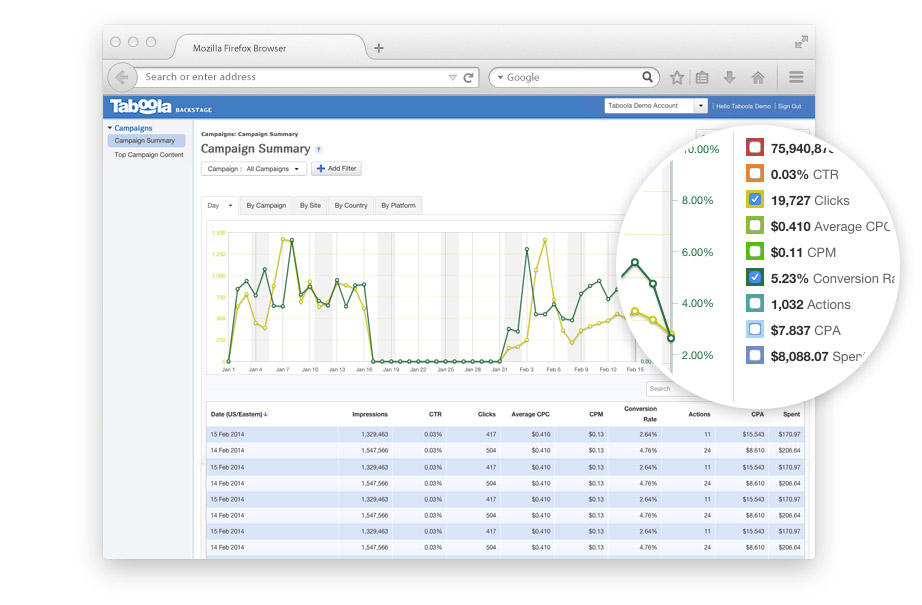

Taboola, a leading technology company specializing in recommendations for the open web, has announced impressive financial results for the first quarter of 2024. The company exceeded the high end of its guidance across all key metrics, showcasing its strong momentum and accelerated growth rates.

In Q1 2024, Taboola reported revenues of $414 million, gross profit of $109 million, and ex-TAC gross profit of $139 million. Despite a net loss of $26 million, the company achieved a non-GAAP net income of $4 million and an adjusted EBITDA of $23 million. Additionally, Taboola generated free cash flow of $27 million.

The company’s year-over-year growth was also notable, with revenues increasing by 26%, ex-TAC gross profit by 20%, adjusted EBITDA by 132%, and free cash flow by 140%. These impressive figures reflect Taboola’s commitment to delivering value to its customers and driving sustainable growth.

Looking ahead, Taboola expects strong year-over-year growth across all metrics for Q2 and the full year of 2024. The company projects Q2 revenues of $425 million, gross profit of $115 million, ex-TAC gross profit of $145 million, and adjusted EBITDA of $25 million or more. For the entire year, Taboola anticipates approximately $2 billion in revenues, $545 million in gross profit, $670 million in ex-TAC gross profit, and an adjusted EBITDA of over $200 million.

Taboola’s focus for 2024 is on improving yield, with a particular emphasis on enhancing retention rates and growing its Net Daily Revenue (NDR). The company’s Maximize Conversion/AI technology, which accounts for nearly 60% of revenue, has been instrumental in driving double-digit NDR improvement. Taboola is also prioritizing premium and quality advertising experiences, with premium brand and agency demand accounting for over 20% of revenue and growing rapidly.

Furthermore, Taboola’s partnerships with Yahoo and Apple News have been instrumental in expanding its reach and engaging users. Yahoo crossed $100 million in revenues in Q1, while the Apple News and Stocks partnership expanded significantly to include the US and UK markets. Taboola’s innovations in Taboola News, such as vertical videos and utilities like weather and games, have further enhanced its offerings.

In addition to its strong financial performance, Taboola has been actively buying back shares, repurchasing $28 million worth of shares in Q1. The company still has $92 million remaining under its current buyback authorization, demonstrating its commitment to creating value for shareholders.

Overall, Taboola’s Q1 2024 results and its positive outlook for the rest of the year highlight its position as a leading player in the digital advertising space. With its focus on advertiser success, expanding partnerships, and continuous innovation, Taboola is well-positioned to drive further growth and solidify its position as a must-buy advertising company for the open web.