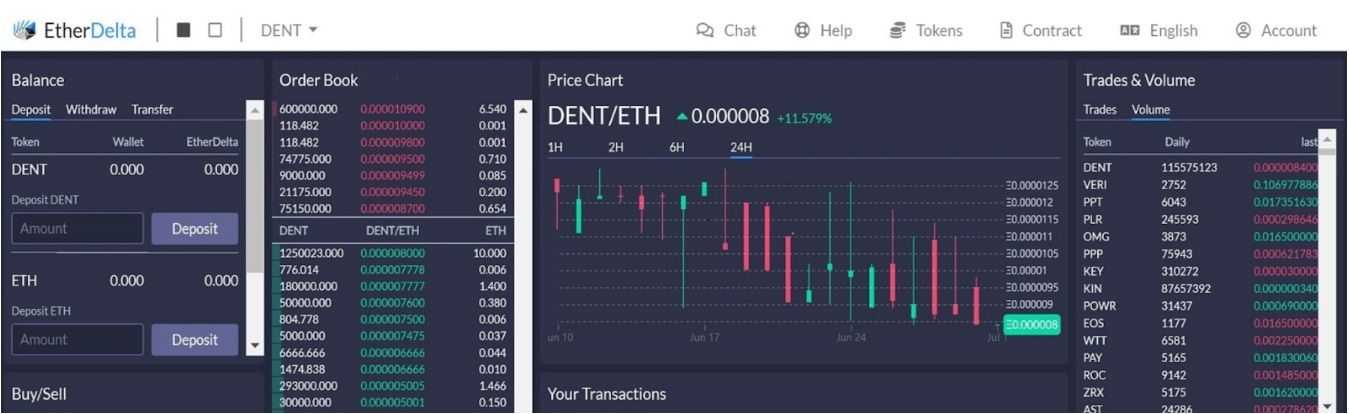

Decentralised exchanges (DEXs) have emerged as a game-changer in the world of cryptocurrency trading. The first DEX, EtherDelta, was introduced in 2016, offering anonymous token swaps and challenging the traditional model of centralised exchanges (CEXs). DEXs operate on automated protocols, enabling direct peer-to-peer transactions without intermediaries. This shift towards decentralisation provides increased security, privacy, and user control over funds.

Uniswap, one of the most recognized DEXs, pioneered the use of automated market makers (AMMs) and has been instrumental in shaping the DEX landscape. Uniswap v4 is currently under development, aiming to enhance user decision-making capabilities and cost-efficiency. Other prominent DEXs include PancakeSwap and SushiSwap, which have adopted similar AMM systems.

Several DEXs operate within specific blockchain ecosystems. Orderly Network on NEAR Protocol focuses on permissionless spot and future order book trading, while Raydium on Solana offers fast and cost-effective trading with cross-chain compatibility. Jupiter Exchange, also on Solana, acts as a DEX aggregator, blending multiple DEXs and AMMs to provide users with the best token swap prices. Osmosis, built for the Cosmos ecosystem, emphasizes interchain communication and scalability.

DEXs offer numerous benefits, including non-custodial control of private keys, uninterrupted trading, enhanced privacy, and early access to new tokens. However, they also present challenges and limitations. Regulatory uncertainties, complex interfaces, liquidity issues, and technical challenges like impermanent loss and price slippage are among the obstacles DEXs face.

While DEXs continue to gain popularity, they are not yet widely accepted due to these impediments. Regulatory compliance and user-friendly interfaces are areas that DEXs need to address to attract a broader user base. Additionally, liquidity and slippage issues need to be mitigated to facilitate smoother trading experiences.

As the DEX landscape evolves, regulatory scrutiny and potential pivots towards more centralised structures may impact the future of decentralised exchanges. The recent regulatory actions against Uniswap and the proposed less decentralised model for SushiSwap highlight the challenges DEXs may face in navigating regulatory landscapes while preserving their core principles.

Overall, DEXs have revolutionized crypto trading by offering increased security, privacy, and user control. As the technology continues to advance and address existing challenges, DEXs have the potential to become a mainstream choice for cryptocurrency traders.